Affordable Lease Offers Adams: Top Offers You Can Not Miss in 2024

Affordable Lease Offers Adams: Top Offers You Can Not Miss in 2024

Blog Article

Checking Out the Price Financial Savings of Car Leasing

In the realm of individual money, the decision in between leasing and buying an automobile is a significant one that calls for mindful consideration. These considerations motivate a closer look at the intricacies of automobile leasing and its effects for long-term economic stability.

Reduced Month-to-month Payments

When thinking about the cost savings of vehicle leasing, one significant advantage is the possibility for reduced regular monthly repayments contrasted to purchasing a lorry. Leasing uses the possibility to drive a brand-new auto with lower ahead of time expenses and regular monthly payments than what would generally be required when getting a car outright. The primary factor for this cost distinction depends on the nature of leasing arrangements, where you are basically paying for the devaluation of the cars and truck over the lease term as opposed to the complete worth of the car.

Reduced month-to-month repayments in renting plans can be associated to different factors. Considering that you are just paying for the devaluation of the lorry during the lease duration, rather than the whole price of the vehicle, monthly repayments have a tendency to be reduced. Additionally, renting often includes lower sales tax obligation compared to buying, better contributing to minimized month-to-month costs. This price can make renting an eye-catching option for people that like a brand-new car every few years without the economic dedication of possession.

Reduced Maintenance Prices

One substantial benefit of automobile leasing is the capacity for lowered maintenance expenses contrasted to owning a car. You are usually covered by the producer's warranty for the duration of the lease when you lease a cars and truck. This indicates that a lot of the mechanical concerns that may develop during the lease duration are likely to be covered by the service warranty, conserving you from needing to spend for costly repairs out of pocket.

Furthermore, rented cars are typically newer and have lower mileage than owned lorries, leading to less upkeep issues. Newer cars and trucks have a tendency to call for much less regular maintenance and are less most likely to experience significant mechanical issues. This can convert right into added cost savings over the lease term, as you will not have to allocate unanticipated upkeep expenditures.

In addition, rented vehicles are usually swapped out for a new design every couple of years, making sure that you are driving a well-kept and dependable vehicle. This normal turn over can add to a problem-free driving experience with marginal maintenance problems, making vehicle renting an appealing alternative for those looking to minimize their general maintenance prices.

Depreciation Cost Savings

Offered the decreased upkeep costs connected with car leasing, another significant advantage worth considering is the potential for depreciation cost savings over the program of the lease term. Devaluation is a major cost variable in lorry ownership, as cars and trucks usually decline with time because of put on and tear, mileage, and market variations. When you lease an auto, you just spend for the depreciation that occurs during the lease duration, as opposed to the whole value of the car. This implies you can drive a new automobile without shouldering the full devaluation expense.

By renting, you transfer this danger to the renting firm, as they take on the obligation for the automobile's future worth. Furthermore, renting more recent designs commonly implies they diminish at a slower rate compared to older vehicles, giving additional potential for devaluation savings.

Tax Obligation Advantages

One of the primary tax obligation advantages of vehicle leasing is the potential to deduct a portion of the lease payments as an organization expenditure. The Internal revenue service enables services to subtract the organization use portion of the lease repayments, along with other costs Homepage such as maintenance and insurance coverage.

In addition, some states provide tax obligation advantages for vehicle leasing, such as exemption from sales tax obligation on the complete value of the vehicle, possibly leading to added price financial savings. In general, understanding and leveraging the tax advantages of cars and truck leasing can lead to substantial economic advantages for both services and people.

Staying Clear Of Bottom-side-up Equity

Understanding the prospective monetary threats connected with automobile leasing, specifically in regard to devaluation, is crucial for people and services blog looking for to avoid bottom-side-up equity (Best lease deals in North Adams). Bottom-side-up equity, additionally called adverse equity, occurs when the value of a leased car diminishes faster than the lessee pays off the lease. This situation can emerge for numerous factors, such as signing a lease with a low deposit, choosing a long lease term, or driving even more miles than set in the lease contract

To avoid searching for yourself in a scenario of upside-down equity, it is vital to research study and pick vehicles that hold their value well over time. Going with autos with high residual worths can help mitigate the danger of depreciation exceeding lease settlements. Additionally, preserving the leased automobile in excellent condition and sticking to gas mileage limits defined in the lease arrangement can additionally avoid negative equity. By being mindful of devaluation rates and making informed choices throughout the leasing procedure, services and individuals can stay away from the challenges related to upside-down equity.

Conclusion

Finally, car leasing uses cost savings with lower month-to-month repayments, minimized maintenance i was reading this expenses, depreciation cost savings, tax obligation advantages, and staying clear of upside-down equity. By taking benefit of these benefits, individuals can take pleasure in the convenience of driving a brand-new auto without the financial burden of ownership. Take into consideration checking out automobile leasing options to possibly save money in the future.

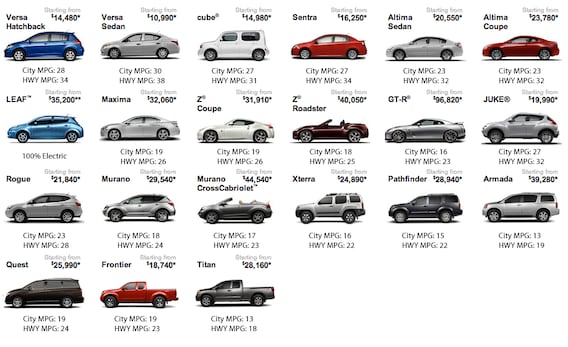

The key reason for this expense distinction exists in the nature of leasing arrangements, where you are essentially paying for the devaluation of the automobile over the lease term rather than the complete worth of the car. - Nissan Rogue lease offers Great Barrington MA

When you lease an auto, you are commonly covered by the producer's warranty for the duration of the lease. When you lease a cars and truck, you just pay for the depreciation that happens during the lease duration, instead than the entire worth of the car. If the rented vehicle is made use of for job-related activities, such as travelling to meetings or visiting customers, a portion of the lease settlements may be tax-deductible. Upside-down equity, also known as negative equity, happens when the value of a rented vehicle drops faster than the lessee pays off the lease.

Report this page